Cheque Security Solutions — Protect Your Business from Cheque Fraud

Over 70% of Canadian businesses face cheque fraud risks. Don’t let yours be next. Our bank-grade security cheques feature true watermarks, gold hologram foil, heat-sensitive ink, and full CPA 2006 compliance — trusted by over 46,000+ businesses nationwide.

✔ 100% CPA 2006 compliant | 🛡️ Gold Hologram & Thermochromic Ink | ⭐ 4.9/5 Google (650+ reviews)

Why Cheque Security Matters

- ✅ Prevent forgery and alteration before cheques reach the bank.

- 🛡️ Protect your brand and accounts from counterfeit cheques and digital tampering.

- 💼 Stay CPA 2006 compliant for predictable acceptance at Canadian financial institutions.

- ⚡ Reduce administrative losses from investigations and rejected deposits.

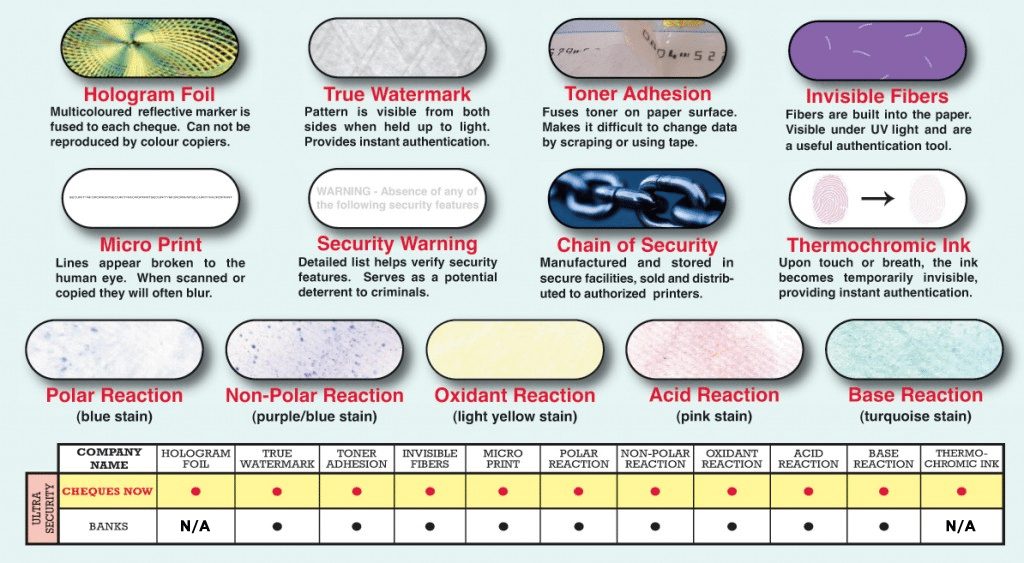

Built-In Protection You Can Verify in Seconds

Each cheque includes:

- True watermark paper (visible under light)

- Gold hologram foil (tilts to animate)

- Heat-sensitive ink (changes when warmed, then returns)

- Microprinting and invisible fibres

- Chemical sensitivity coating and toner adhesion

Common Cheque Fraud Threats

1️⃣ Forgery & Check Washing

Criminals remove ink or alter payee names. Our heat-sensitive ink and chemical-resistant stock expose tampering instantly.

2️⃣ Counterfeit Cheques

Scanners and colour copiers can’t replicate true watermarks or hologram foils — easy for tellers to spot, hard for fraudsters to fake.

3️⃣ Digital & Phishing Fraud

Cybercriminals target templates and banking data. Visible + covert features make duplication and unauthorized printing ineffective.

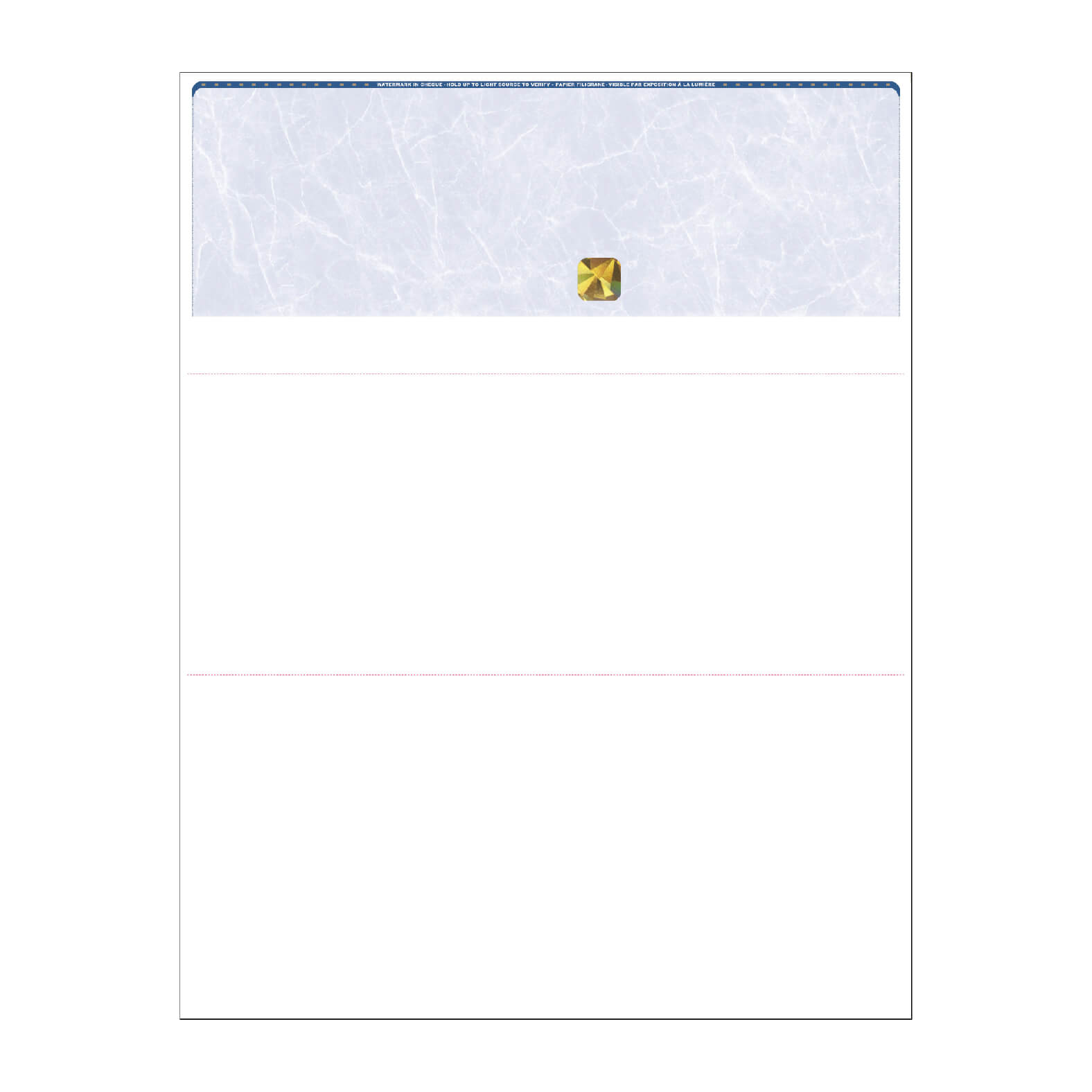

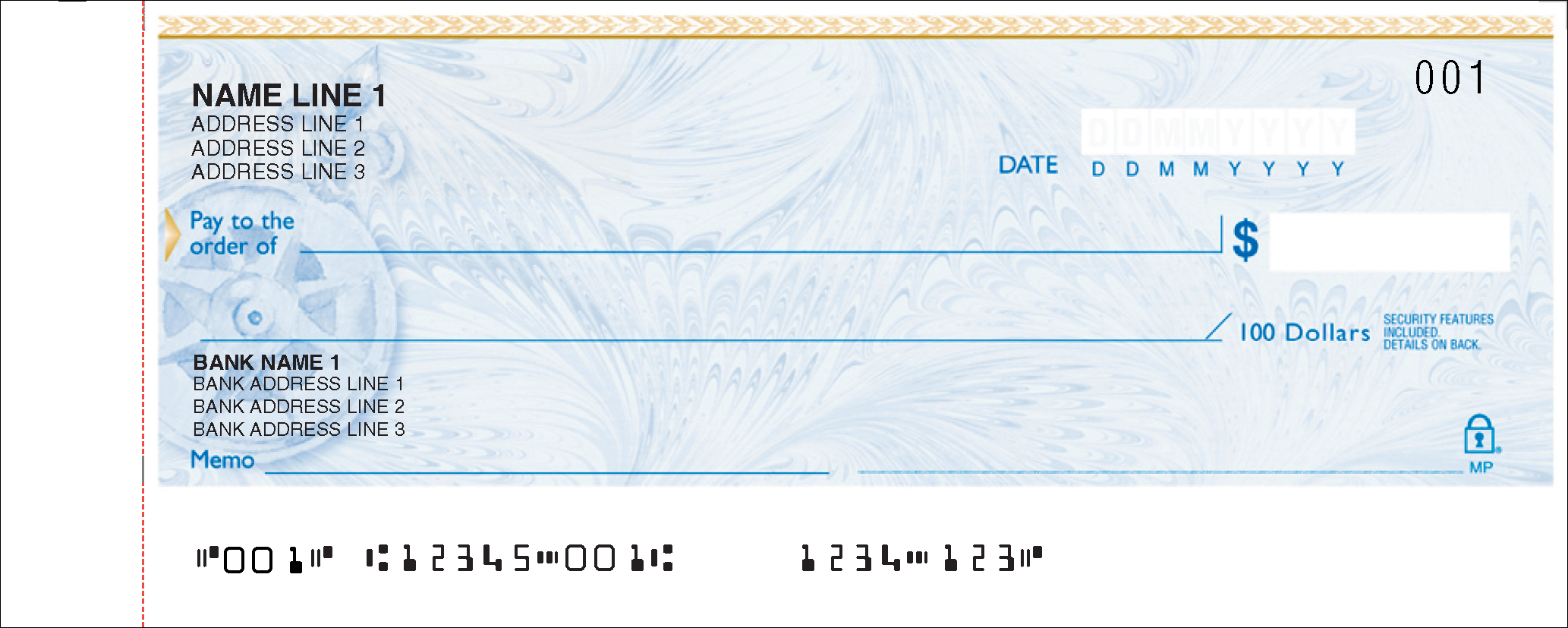

See Our Secure Cheques

Choose the Right Secure Cheque for Your Business

Every cheque we print includes advanced fraud protection and CPA 2006 compliance.

| Cheque Type | Best For | Security Features | Bonus Offer | Order |

|---|---|---|---|---|

| Laser Cheques | QuickBooks®, Sage, AgExpert users | Full suite + hologram & heat ink | 25% More Free | Order Laser |

| Manual Cheques | On-the-go or field payments | Watermark, hologram, heat ink | 50% More Free | Order Manual |

| Blank Cheques | Print your own securely | Security stock only (CPA 2006) | Save 20% | Order Blank |

| Personal Cheques | Individuals & small businesses | CPA 2006 compliant stock | 60% More Free | Order Personal |

Trusted by 46,000+ Canadian Businesses

“Excellent quality, fast delivery, and unbeatable service. We switched from our bank supplier and saved hundreds.”

⭐ 4.9/5 on Google (650+ verified reviews)

Our Guarantee

- ✔ Accurate Printing or we reprint free.

- ✔ Bank Acceptance Guarantee — 100% CPA 2006 compliant.

- ✔ Priority Rush Available — next-day across most of Canada.

Cheque Security — FAQs

Are secure cheques worth it?

Yes. Layered security (watermark, hologram foil, heat-sensitive ink, microprinting) helps prevent fraud and teller rejections — protecting cash flow and reputation. Our cheques are 100% CPA 2006 compliant and trusted nationwide.

What makes a cheque safe?

Multiple visible and covert elements: true watermark paper, hologram gold foil, thermochromic (heat-sensitive) ink, microprinting, invisible fibres, chemical sensitivities, and toner adhesion. These deter duplication, alteration, and washing.

Are your cheques accepted by Canadian banks?

Yes. We’re CPA 2006 compliant (Printer ID #1010). Our formatting and security features support reliable MICR reads and teller verification across Canada.

Do I need MICR toner for laser cheques?

Some banks recommend MICR toner for the clearest magnetic reads. Our stock is MICR-friendly; we can advise based on your software/printer. Call 1-866-760-2661.

What’s the difference between blank and preprinted cheques?

Blank cheques let you print company/bank details yourself (software-ready layouts). Preprinted cheques arrive with your details already printed — just load and print payee/amount.

How fast can I get secure cheques?

Most orders proof within hours; next-day rush is available to most Canadian locations once approved.

Which cheque type is best for my business?

Laser for QuickBooks®/Sage workflows; Manual for field payments; Blank if you print in-house; Personal for individuals and small operators. See the comparison table above.

Ready to Protect Your Cheques?

Order CPA-compliant, fraud-resistant cheques online in minutes. Next-day rush available nationwide.

Earn AIR MILES® on every order | CPA Self-Accredited Printer ID #1010