Same-Day Print • Next-Day Delivery*

Express Delivery Cheque Printing for Businesses

CPA-compliant, fraud-resistant cheques—printed today, delivered to most Canadian urban centres by tomorrow. We Price Match and you earn AIR MILES® Reward Miles.

- ✔ CPA-Approved Layouts

- ✔ Price Match Any Supplier

- ✔ Next-Day Rush (most urban areas)

- ✔ Earn AIR MILES® on every order

*Cut-off times apply; coverage varies by carrier/routes.

Quick Cheque Printing Services

Fast, Secure & Affordable — Built for Business-to-Business Needs

You need cheques now. We print the same day and ship overnight to most Canadian urban centres. Choose pre-printed Laser, Manual, Personal, or Blank cheque stock compatible with all major accounting and online banking workflows.

- ⚡ Fast: Same-day print, next-day delivery options.

- 🛡️ Secure: Microprinting, heat-sensitive ink, anti-copy screens & more.

- 💼 B2B-Ready: Vendor-friendly, accounting-software compatible (laser printer friendly).

- 🏷️ Price Match: We match any supplier on apples-to-apples specs.

- 🧾 CPA-Compliant: Guaranteed bank acceptance.

- ✈️ Rush Nationwide: Reliable carriers; live humans to help: 1-866-760-2661.

Order

Pick Your Express Cheques

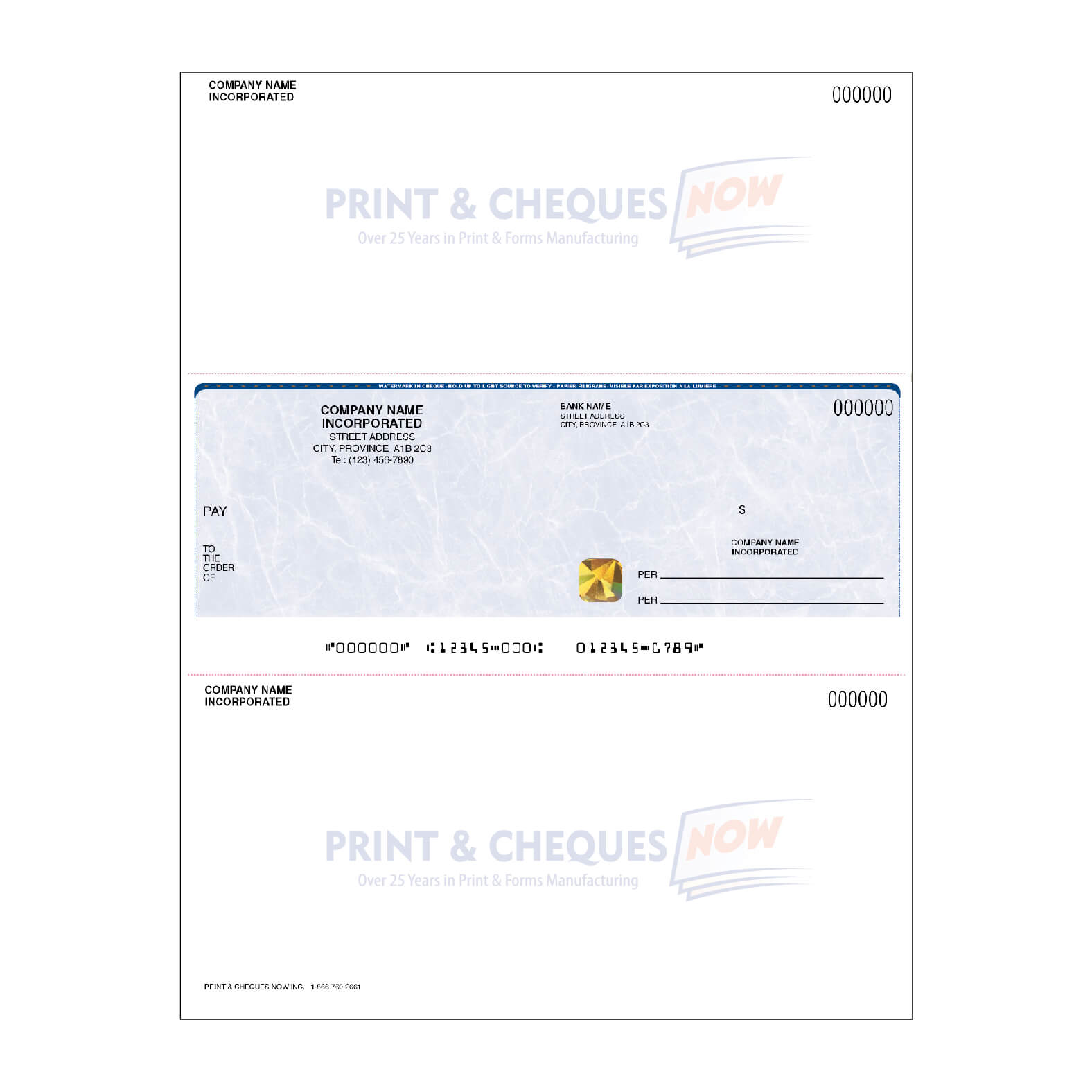

Laser Cheques (Pre-Printed)

Top/Middle/Bottom positions. Brand colours & logos. CPA-approved.

Manual Cheques

1-per-page with long voucher. Rugged covers, deposit books available.

Blank Cheque Stock

Secure base stock for your laser printer. Multiple colours.

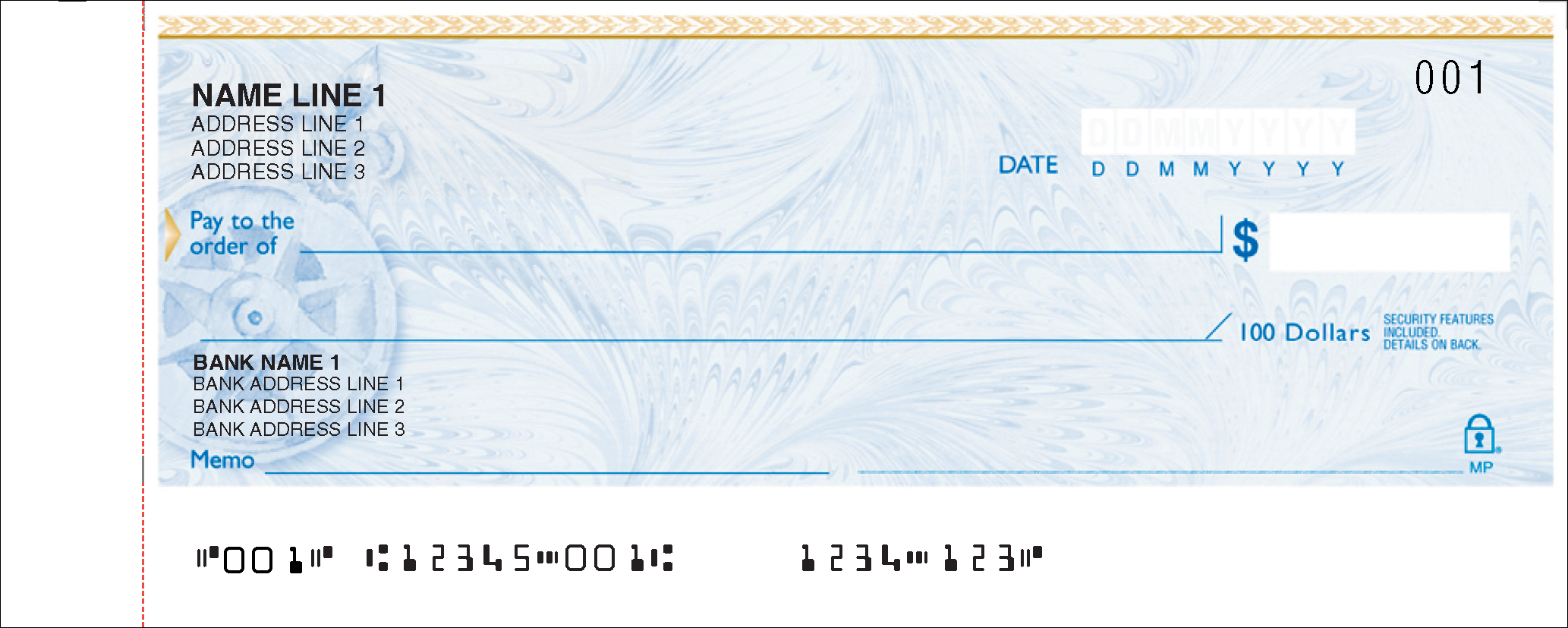

Personal Cheques

Bank-ready designs. Secure features. Quick reorder.

Fast • Secure • Vendor-Friendly

Why Choose Our Express Service?

Bank-Grade Security

Microprinting, heat-sensitive inks, chemical-wash detection, and anti-copy screens help defeat fraud. All layouts CPA-compliant for bank acceptance.

- Guaranteed online banking & vendor compatibility

- Laser-printer friendly stock

- Price Match on equivalent specs

Same-Day to Next-Day Delivery

Place your order early; we print immediately and rush ship. Most urban Canadian addresses receive next-day.

Prefer to talk it through? Call 1-866-760-2661 and we’ll confirm timelines live.

Cheque-Related Products

Everything You Need to Ship with Your Cheques

Cheque Binders & Covers

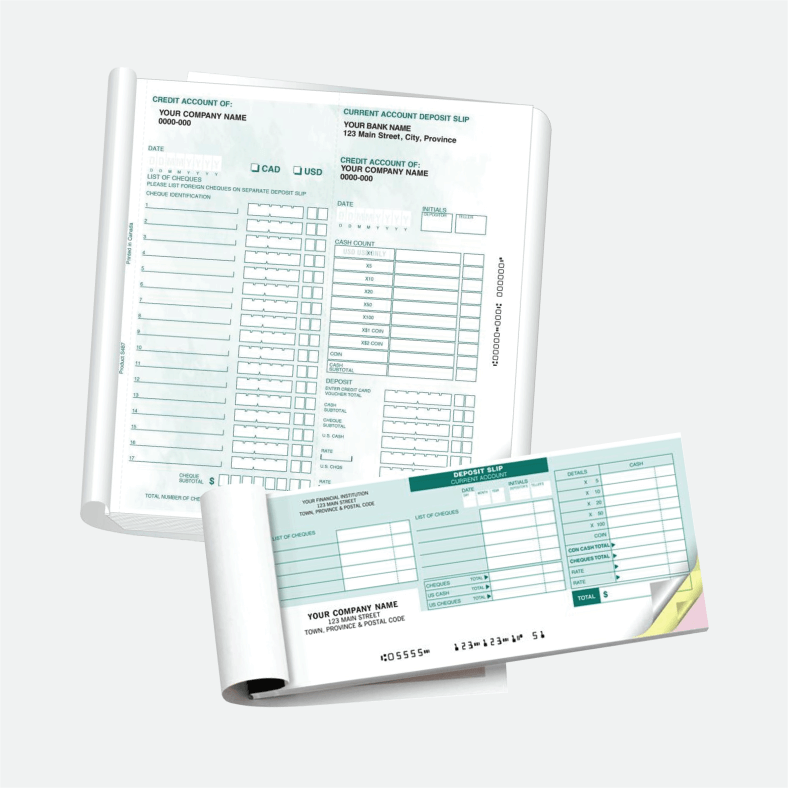

Deposit Books & Slips

Security Deposit Bags

Self-Seal Envelopes

FAQ

Quick Answers

How fast can I get my cheques?

Are your cheques CPA-compliant and bank-accepted?

Can you match my software print position?

Do you price match?

What payment methods do you accept?

Ready for Same-Day Print?

Earn AIR MILES® on every order • CPA Self-Accredited Printer