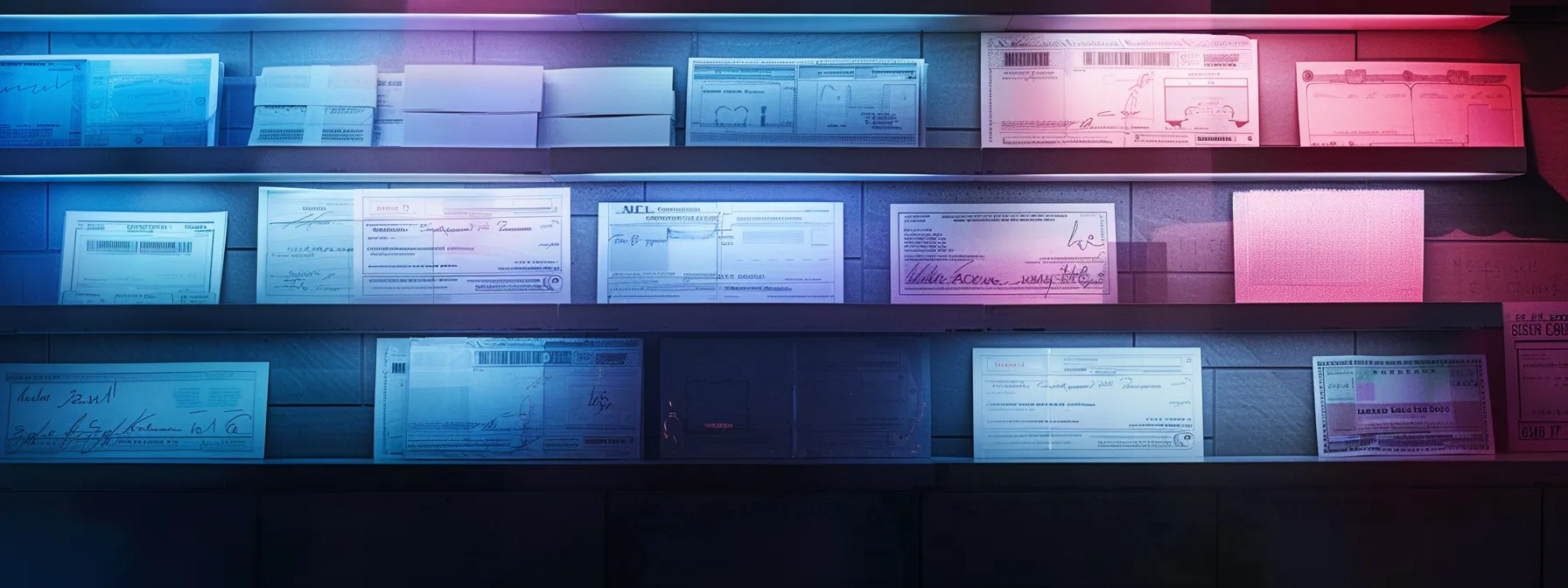

Types of Business Cheques You Need to Know

When it comes to managing business finances, many owners overlook the importance of understanding the various types of business cheques available. This blog post will explore common types of business cheques, secure methods of writing them, and digital alternatives that could simplify your financial processes. By reading on, business owners will gain insights into selecting the right cheque type for their needs, which can help avoid costly errors and streamline payments. If you’ve been struggling with cheque options or security concerns, this content will guide you towards smarter cheque management.

Overview of Business Cheques

Business cheques serve as essential tools for managing salary payments, settling debts, and maintaining a deposit account. They play a significant role in facilitating transactions while helping to mitigate risks like identity theft. Understanding the various types of business cheques, including manual cheques, and their compatibility with accounting software as recommended by payments canada, is crucial for effective financial management. This overview will lead into detailed discussions on the specific types of cheques important for any business.

Defining Business Cheques and Their Purpose

Business cheques are an important part of a company’s financial toolkit, allowing them to manage payments to employees and vendors. These cheques are linked to a bank account, providing a secure means of transaction while helping businesses maintain accurate financial records. By using cheques, businesses can keep better track of cash flow and payments made, which is essential for operational efficiency.

One of the main purposes of business cheques is to offer a safer alternative to cash transactions. With secured features against forgery, these cheques minimize the risk of theft or loss, providing peace of mind to business owners. Moreover, businesses can easily include their email address on the cheque for customer communication, making it simple to resolve any payment-related queries that may arise.

Additionally, cheques can enhance professionalism when dealing with customers. They indicate that a business is organized and serious about its operations. This positive impression can foster trust and strengthen relationships with clients, paving the way for repeat business. Ultimately, understanding how to effectively use business cheques can significantly benefit a company’s financial management and customer interactions.

The Importance of Business Cheques in Transactions

Business cheques are vital for transactions, as they facilitate secure payments and maintain accurate financial records. Unlike cash transactions, which can lead to potential losses and theft, cheques provide a reliable method for businesses to settle debts with vendors and employees. Utilizing inks with security features can also help prevent forgery, further ensuring safe transactions.

In today’s world, many businesses also connect their cheque processes with online banking systems, allowing for seamless transfers and management of funds. Cheques can efficiently leverage a clearing house for processing, enhancing the speed and reliability of funds transfer. Each time a cheque is processed, companies can rest easy knowing their payments are on a secure path and less likely to encounter issues.

It’s essential for businesses to note how cheques contribute to a professional image. Using cheques demonstrates an organized approach to managing finances, which can help build trust with clients and partners. Including a disclaimer on cheques can also clarify any potential issues, making it easier for businesses to communicate effectively, especially in scenarios involving mutual funds or other investments where transparency can be crucial.

Business cheques come in many forms, each serving a purpose in daily transactions. Let’s look closer at the common types of business cheques and how they fit into your operations.

Common Types of Business Cheques

When it comes to business cheques, distinguishing between personal and business cheques is essential. Understanding certified cheques can help ensure secure transactions, while cashier’s cheques offer reliability for larger payments. Payroll cheques are crucial for managing employee salaries effectively. Each type plays a role in maintaining a transaction account and utilizes magnetic ink character recognition for quick processing, ensuring accuracy and security in financial operations.

Distinguishing Between Personal and Business Cheques

When it comes to cheque processing, understanding the differences between personal and business cheques is essential. Personal cheques are typically issued from an individual’s bank account, whereas business cheques are linked directly to a company’s account. This distinction is important as it impacts how transactions are conducted and tracked within a business setting.

Business cheques often carry features tailored for corporate needs, such as increased security measures and specific fields for documentation purposes. For instance, a company may include the business name and logo on their cheques, presenting a professional image that enhances trust. On the other hand, personal cheques might only contain the individual’s name and address, which may not convey the same level of professionalism.

In the current landscape of finance, using business cheques can be more advantageous than relying on payment cards. For larger transactions, a demand draft is often recommended due to its reliability. By utilizing the appropriate cheque type, businesses can maintain efficient cash flow management and improve their overall financial health.

Understanding Certified Cheques

Certified cheques are a reliable option for businesses looking to make secure payments. Unlike regular cheques, which can bounce if there aren’t sufficient funds in the linked savings account, certified cheques guarantee that the amount is available. This added assurance makes them ideal for larger transactions where the risk of payment issues could cause significant problems.

One notable feature of certified cheques is that a bank verifies the funds before issuing the cheque, meaning the money is set aside for the payment. While there is often a fee associated with obtaining a certified cheque, many businesses find the security and peace of mind it provides to be well worth the cost. This is especially true for businesses that prefer to avoid the hassle of dealing with bounced payments that can occur with wire transfers or debit cards.

Using certified cheques can also strengthen trust with vendors or clients. Due to their secure nature, recipients see these cheques as a commitment to honor the payment. When companies choose to utilize certified cheques, they can effectively manage cash flow while minimizing the risk associated with payment processes, ultimately fostering stronger relationships in their business dealings.

Exploring Cashier’s Cheques and Their Uses

Cashier’s cheques are a reliable payment option for businesses, especially when handling significant transactions. These cheques, issued by a bank, are backed by the bank’s funds, reducing the risk of bounced payments. This makes them particularly attractive for retail operations or large purchases, where certainty of payment is essential.

When utilizing cashier’s cheques, businesses can ensure they meet the necessary financial standards set by institutions like the Reserve Bank of India. These institutions regulate cheque operations, highlighting the importance of using secure payment methods in transactions. With the growing move toward digital transactions and concepts like central bank digital currencies, understanding the role of cashier’s cheques becomes crucial.

For companies seeking efficiency, cashier’s cheques can simplify payment processes. Many businesses favor these over preprinted laser cheques when a high level of security is required. By adopting cashier’s cheques, organizations can maintain a strong financial reputation while further establishing trust with clients and vendors, making them an essential tool in any business’s financial toolkit.

Insights on Payroll Cheques and Handling

Payroll cheques are essential for businesses to ensure employees are paid accurately and on time. They function as a negotiable instrument that automatically links compensation to the company’s bank account, which streamlines payroll management. To safeguard against issues such as dishonoured cheques, companies often implement strict authentication methods, ensuring that only authorized personnel can issue these payments.

Using automated teller machines (ATMs) can enhance the convenience of payroll cheques. Employees can deposit their payroll cheques directly into their accounts, simplifying the cashing process. This efficiency prevents delays in accessing funds and helps employees manage their finances more effectively, eliminating the stress of waiting for payments to clear.

For businesses that want to provide further payment options, integrating money orders as an alternative can be beneficial. Money orders offer a secure way to compensate those who may not have access to traditional banking services. By considering diverse payment methods like payroll cheques and money orders, companies can accommodate various employee needs, ultimately fostering a supportive work environment.

Writing a cheque should be straightforward, but securing it is where care matters most. Next, let’s explore how to ensure your payments stay safe and sound in a world full of risks.

Secure Methods of Writing Business Cheques

Best practices for filling out business cheques include ensuring accuracy to prevent issues in your accounting records. Avoiding common mistakes when issuing cheques is also crucial, especially when dealing with drafts or cheque truncation in a payment system. These practices help maintain security and trust in transactions, guiding businesses in issuing the right payment method without the risks associated with a blank cheque.

Best Practices for Filling Out Business Cheques

When filling out business cheques, accuracy is key. The drawer, or the entity issuing the cheque, should ensure the name of the payee is spelled correctly and matches their records. This avoids potential issues at the bank and helps maintain smooth transactions, especially important in the current climate where businesses are shifting towards digital currency.

It’s also essential to properly record the amount in both numerical and written form. This prevents misunderstandings about how much is being paid. A good practice is to review the cheque for clarity before handing it over, which can save time and potential headaches later on when interacting with the credit union or other financial institutions.

Finally, signing the cheque should be done with care to keep it consistent with the signature on file at the bank. Using secure methods ensures that the cheque process remains reliable, aiding businesses in maintaining trust with clients and vendors. As transactions evolve with central bank regulatory changes, these best practices keep financial dealings transparent and straightforward.

Avoiding Common Mistakes When Issuing Cheques

When issuing cheques, one of the biggest mistakes businesses can make is overlooking the details. A simple misspelling of a payee’s name or an incorrect amount can lead to cheque fraud or costly delays in payment processing. Ensuring accuracy is essential for reducing liability and avoiding potential disputes. Always double-check the cheque before distribution to maintain control over the transaction process.

Another common pitfall is neglecting to use secure methods when writing cheques. This includes not incorporating security features, such as watermarks or special inks that can guard against fraud. Businesses should also be cautious when using mobile banking for cheque issuance, ensuring that their connection is secure to avoid unwarranted access to sensitive financial information.

Lastly, businesses must account for the possibility of lost or stolen cheques. Implementing proper cheque tracking and maintaining a log can help mitigate risks. By keeping thorough records, businesses can quickly address any issues that arise and ensure that they are well-protected against any cheating attempts. This proactive stance fosters a reliable financial environment and strengthens trust with clients and partners.

While solid methods for writing business cheques are vital, new options are rising. The shift to digital tools offers speed and convenience that many are starting to prefer.

Digital Alternatives to Traditional Business Cheques

Electronic cheques are gaining traction as an efficient alternative to traditional business cheques, offering benefits such as quick processing and enhanced security. With the rise of online payment systems, businesses can streamline their transactions, minimizing the role of physical cheques. This section will explore how electronic drafts work within the cheque clearing process and discuss the role financial institutions play in currency transactions.

Exploring Electronic Cheques and Their Benefits

Electronic cheques are becoming a preferred choice for businesses looking to streamline their payment processes. With the ability to transfer funds quickly without relying on cash, organizations can easily manage transactions while keeping detailed records. By utilizing electronic cheques, companies can also reduce the risk associated with traditional methods, helping to avert issues like bounced payments that can disrupt operations.

Moreover, electronic cheques offer companies a reliable alternative for securing business loans or settling debts, such as when using a promissory note. These digital transactions are often tracked more efficiently, providing clarity and enhancing accountability. With advanced security features, electronic cheques improve the overall confidence businesses have in their payment methods, fostering better relationships with clients and vendors.

As financial environments adapt to new technologies, understanding electronic cheques and their benefits ensures businesses stay competitive. Organizations can manage payroll more effectively and expedite cash flow, which is crucial for maintaining operational stability. By shifting towards electronic options, businesses can easily meet their financial needs while minimizing risks that often come with traditional cheque processing.

The Rise of Online Payment Systems

Online payment systems have transformed the way businesses handle transactions, making them faster and more efficient than traditional methods. Companies now have the opportunity to process payroll and make payments in Canada instantly, which simplifies operations and significantly enhances cash flow management. This innovation allows businesses to meet their financial obligations without delays, which can be crucial in maintaining healthy relationships with employees and vendors.

These digital solutions are equipped with advanced security features that help protect sensitive information, creating confidence among business owners and clients alike. Many online payment platforms come with integrations that allow for seamless tracking of credit transactions, making record-keeping straightforward. As organizations move towards these systems, they can effectively reduce the risk associated with lost or stolen cheques, thus fostering a more secure transaction environment.

As the landscape of business payments continues to evolve, the rise of online payment systems ensures that companies remain competitive. By adapting to these modern methods, businesses can streamline their payment processes, thereby addressing common pain points such as delays in processing or manual errors in accounting. Ultimately, embracing these digital alternatives allows organizations to maintain strong operational practices while focusing on growth and efficiency.

As businesses consider digital alternatives, they must also navigate the rules that govern these choices. Understanding the legal side of cheque printing is just as crucial as the methods themselves.

Legal and Regulatory Considerations

Understanding the laws governing business cheques is essential for any organization. Compliance with regulations helps businesses manage risks associated with cheque payments, keeping transactions secure. This section will cover key points on legal requirements and best practices, as well as strategies to mitigate risks, ensuring that companies can handle cheque processes confidently and effectively.

Understanding the Laws Governing Business Cheques

Understanding the laws governing business cheques is crucial for any organization involved in handling payments. Each province in Canada may have specific regulations that dictate requirements for issuing, processing, and storing these documents. Businesses should familiarize themselves with these legal obligations to ensure compliance and protect against potential liabilities.

In Canada, the Canadian Payments Association (CPA) plays a key role in setting the standards for cheque processing. Their guidelines help businesses align their cheque operations with national regulations, ensuring that all business cheques are compliant with industry standards. Ignoring these regulations can lead to issues like bounced cheques or even legal disputes, which can disrupt cash flow and tarnish reputations.

With the rise of digital transactions, it’s also important for businesses to stay updated on emerging laws related to electronic cheques. Many organizations are now using electronic payment systems, and understanding how these interact with traditional cheque laws can help businesses navigate potential challenges. By staying informed and compliant, companies can confidently manage their cheque processes while minimizing risks associated with payments.

Managing Risks Associated With Cheque Payments

Managing risks associated with cheque payments is essential for any business. Companies should regularly check their processes to ensure that all cheque transactions are secure. By implementing verification procedures, such as confirming payee information before issuing a cheque, businesses can reduce the chances of fraud or errors that may lead to financial loss.

Businesses also benefit from maintaining thorough records of all cheque transactions. Keeping a log that includes cheque numbers, payee names, and amounts can help in tracking payments effectively. In case of discrepancies or disputes, accurate records provide clarity and assist in resolving issues swiftly, which is crucial for maintaining trust with clients and vendors.

Lastly, businesses should stay informed about changes in regulations governing cheque transactions. Understanding local laws helps companies avoid potential legal pitfalls and ensures compliance. By continuously educating staff about cheque handling best practices and security measures, businesses can create a safer and more reliable payment environment that protects their interests and strengthens client relationships.

Understanding the legal landscape is just the start. Now, let’s dig into practical tips that will make cheque writing easier for businesses.

Practical Tips for Businesses

Safeguarding against cheque fraud is essential for any business using cheques. Implementing secure practices minimizes risks while ensuring smooth transactions. Additionally, keeping accurate records for business cheques helps track payments and reduces potential discrepancies. These topics will provide practical insights, enabling businesses to enhance financial security and maintain trust with clients and vendors.

Safeguarding Against Cheque Fraud

To safeguard against cheque fraud, businesses can implement secure storage solutions for their cheques and banking materials. Keeping cheques locked up when not in use helps prevent unauthorized access, which is crucial for maintaining financial security. Ensuring that only trusted employees have access to these materials further minimizes the risk of fraudulent activity.

Another practical measure is to use security features on cheques, such as watermarks or special inks that are difficult to replicate. These features can provide an additional layer of protection, making it harder for anyone to alter or forge cheques. By choosing print services that prioritize security, businesses can enhance the integrity of their cheque transactions significantly.

Regularly monitoring cheque transactions can help identify any irregularities early on. Setting up alerts for large transactions or unusual activity ensures that businesses can act quickly if something seems off. By being proactive and keeping a watchful eye on financial processes, organizations can reduce their exposure to cheque fraud while maintaining smooth operations.

Record Keeping for Business Cheques

Keeping accurate records of business cheques is crucial for maintaining smooth financial operations. Each cheque issued should be logged with important details like the cheque number, date, payee name, and amount. This practice not only helps prevent discrepancies but also provides a reliable reference in case any questions arise later on.

Businesses can enhance their record-keeping practices by utilizing accounting software that integrates cheque tracking. This allows for real-time updates and easy access to past transactions, making it simpler to conduct audits or generate financial reports. By staying organized, companies can avoid potential payment issues and keep their finances on track.

Regularly reviewing cheque records can help identify unusual patterns, such as unauthorized payments. By maintaining a close watch on transactions, businesses can uncover fraud early and take immediate action to protect their assets. This proactive approach ensures that cheque management remains secure and trustworthy while bolstering relationships with vendors and clients.