Ordering duplicate personal cheques can feel daunting, but I’ll walk you through every detail. Whether you bank with RBC, Scotiabank, or a credit union like Servus Credit Union, this guide helps you order duplicate personal cheques online safely and affordably. By the end, you’ll know exactly how to gather banking information, select the right format, customize security features, and place your order with confidence.

Why Duplicate Personal Cheques Matter

I’ve found that having duplicate cheques—carbonless or carbon-copy sets—is a game changer for record keeping. Each time you write a cheque, a second copy remains in your chequebook. That means automatic transaction logs and an easy audit trail for small business expenses or personal budgeting. Duplicate Personal Cheques also offer peace of mind: you can cross-check amounts, dates, and payees without rifling through bank statements.

Carbonless multipart cheques rely on micro-encapsulated dye and coated paper layers. When you write on the top sheet, the pressure transfers ink onto the underlying canary copy. Your bank—whether TD Canada Trust or National Bank—processes the top sheet via MICR (Magnetic Ink Character Recognition) encoding, while you keep the pristine duplicate for your records.

I’ve tested ordering services from Cheque Print Solutions, ChequesPlus, and Print & Cheques Now. Across the board, duplicate formats comply with CPA (Canadian Payments Association) 006 standards. That ensures your cheque meets bank requirements for dimensions, MICR line placement, and security features like warning bands, fluorescent fibers, and colored backgrounds.

Step 1: Gather Your Banking Details

Before you order duplicate personal cheques, I always double-check three key pieces of information with my branch:

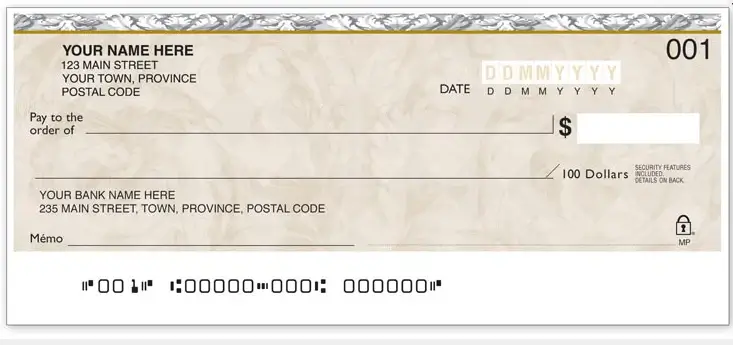

- Transit Number Located typically on the left of your MICR line, the transit number identifies your specific branch. For instance, a Scotiabank transit looks like 12345.

- Institution Number A three-digit code representing your bank—like 002 for TD or 003 for RBC—follows your transit number in the MICR line.

- Account Number Your unique bank account number appears after the institution code. It can range from 7 to 12 digits.

Gathering these details ahead of time prevents delays and ensures your duplicate cheques process correctly through Canada Post and automated clearing houses.

Step 2: Choose the Right Cheque Format

Duplicate cheques come in several formats:

- Carbonless Two-Part Sets The standard option: a white top sheet and a yellow underlying copy. Recommended for personal budgeting.

- Triplicate or Multi-Part Adds an extra copy for businesses needing three-part records—one for you, one for accounting, one for the payee.

- Custom Laser-Compatible Cheques If you use QuickBooks or Sage, you might prefer laser-ready duplicate Personal Cheques printed on perforated stock.

Every format adheres to CPA specifications, but I prefer carbonless sets for personal use. The underlying sheet remains clean and legible, letting me file each transaction by date.

Table 1: Cheque Format Comparison

| Format | Parts | Best For | Compatibility |

| Carbonless Two-Part | 2 | Personal record keeping | All Canadian banks & CUs |

| Triplicate or Multi-Part | 3+ | Small business bookkeeping | CPA-006 laser printers |

| Laser-Ready Duplicate | 2 | Accounting software (QuickBooks) | HP, Epson, Canon printers |

Step 3: Selecting Quantity and Pricing

When I order cheques, I compare pricing tiers and extra perks. Many printers—including us at Cheques Now—offer 60% more Duplicate Personal Cheques for free on qualifying orders.

Table 2: Sample Price Comparison

| Quantity Purchased | Quantity Received (Print & Cheques Now) | Estimated Cost (CAD) |

| 50 cheques | 80 cheques | $73 |

| 100 cheques | 160 cheques | $82 |

| 200 cheques | 320 cheques | $115 |

ChequesPlus and Cheque Print Solutions often match bank pricing, but they rarely include bonus cheques. By choosing us, you stretch your dollar further without sacrificing CPA-compliant high-security paper.

If you need more detailed breakdowns on duplicate cheque prices, just navigate to our pricing section for live quotes.

Step 4: Entering Your Personal Information

With format and quantity chosen, I carefully populate the online form:

- Account Holder Name Exactly as it appears on your bank record.

- Address and Contact Street address, province, postal code, and a contact phone.

- Transit & Institution Numbers Confirmed from your cheque stub or online banking.

- Account Number Double-checked for accuracy—this prevents misprinted MICR lines.

I always review the live proof option before finalizing. Hover your mouse over the PDF proof link and inspect each MICR digit, font, and alignment. If you spot errors, edit them immediately.

Step 5: Customization and Security Options

Cheques Now offers advanced security features beyond CPA requirements:

- Microprinting Tiny text inside signature lines that appears as a solid line to the naked eye but foils counterfeiters.

- Warning Bands Invisible ink that fluoresces under UV light, alerting you to tampering.

- Colored Backgrounds Gradient patterns that make digital copying difficult.

- Clear Vinyl Wallet An optional slip-in wallet protects your cheques on the go, preventing creases or ink smudges.

- Laser-Compatible Encryption If you run QuickBooks or other accounting software, encrypted fonts ensure your cheque details remain unreadable when scanned.

I typically select microprinting and the vinyl wallet—small investments that deliver big security and durability. If you’re new to cheques, check out our tips on mistakes when ordering duplicate cheques to avoid common missteps.

Step 6: Review and Avoid Common Mistakes

Even with a perfect form, simple mistakes can creep in. I’ve identified recurring errors in my years of ordering:

- Transposed digits in your account number.

- Wrong transit code—mixing branch vs. head office numbers.

- Selecting single instead of duplicate format.

- Ignoring the PDF proof for color bleed or font issues.

To dodge these pitfalls, set aside five extra minutes for a final proof read. If anything feels off, use the “Edit Order” link. Plus, our customer service team at Cheques Now is available to verify your details before printing.

Step 7: Place Your Order and Delivery Options

Once you click “Submit Order,” here’s what happens:

- Order Confirmation You’ll receive an email summary with estimated delivery dates.

- Proof Approval For custom logos or monograms, we send a digital proof for sign-off within 24 hours.

- Production High-security paper is printed in our CPA-certified facility.

- Shipping We use Canada Post—standard shipping takes 6–10 business days nationwide. Rush shipping (3–5 days) is available for an extra fee.

Tracking numbers arrive via email so you can monitor progress until your cheques land in your mailbox.

FAQs

Where can I order duplicate personal cheques online in Canada?

You can order duplicate personal cheques from specialized printers like Cheques Now, Cheque Print Solutions, and ChequesPlus. We all comply with CPA standards and partner with Canada Post for secure delivery.

Can I re-order my duplicate personal cheques quickly?

Yes. Once you’ve placed your initial order, Cheques Now retains your banking details securely. A few clicks let you reorder the same quantity and format—no re-entry required.

Are duplicate cheques compatible with bank-printed cheques?

Absolutely. Our duplicate Personal Cheques are designed to match exactly the MICR dimensions and security specs of bank-printed cheques. You won’t face rejection at any Canadian financial institution.

How long does it take to receive my duplicate cheques?

Standard delivery via Canada Post takes 6–10 business days. Upgraded Rush service can shorten that to 3–5 days if you need duplicates in a hurry.

What security features protect my duplicate personal cheques?

Features include microprinting, warning bands, fluorescent fibers, colored backgrounds, and optional clear vinyl wallets. All meet or exceed CPA 006 requirements.