When you hold a cheque in your hand, it might look like a simple piece of paper. But each line, number, and symbol plays a vital role in ensuring your payment reaches the right place. From the date line to the intricate MICR routing number, every element is designed for accuracy, security, and efficiency. Whether you’re learning how to read one or planning to order cheques in Canada, understanding these components is crucial. In this guide, I’ll walk you through every part of a cheque, explain how your bank reads those tiny magnetic numbers, and explore essential cheque security features that protect you against fraud. By the end, you’ll know exactly what each component does—and what to watch for when you write or receive a cheque.

The Key Components of a Cheque

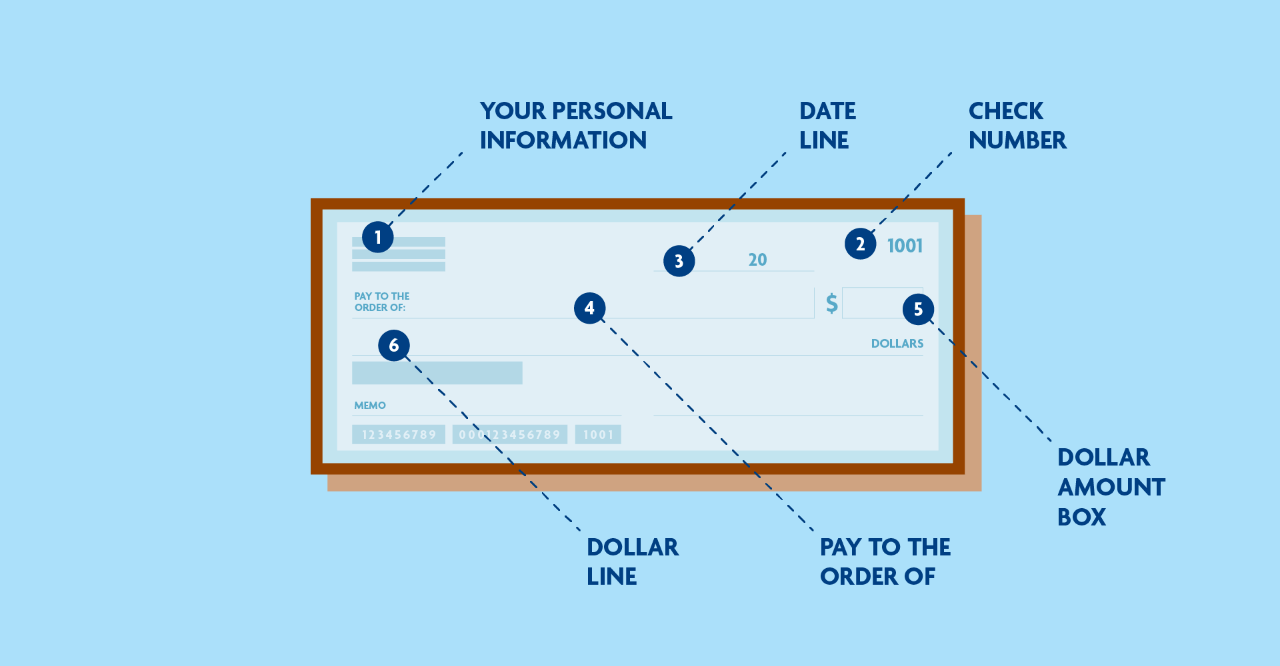

Every cheque has a standardized layout to help banks process payments quickly. Although formats vary slightly between institutions, these core elements remain consistent.

- Date Line This is where you write when the cheque was issued. It determines the start of the validity period—typically three months for most banks.

- Payee Line Labeled “Pay to the Order of,” this section names who can deposit or cash the cheque. Accuracy here prevents delays or rejections during clearing.

- Numeric Amount Box Printed inside a bordered box, the number shows exactly how much to pay—for example, “$1,250.00.” This numeric representation helps avoid misinterpretation.

- Written Amount Line Directly below the payee line, you spell out the amount in words: “One thousand two hundred fifty and 00/100 dollars.” If there’s a discrepancy between words and numbers, banks defer to the written amount.

- Memo Line An optional field in the lower-left corner where you jot a note—like “Invoice 453” or “April Rent.” It’s for your records, not a requirement for processing.

- Signature Line Your signature here authorizes the bank to transfer funds. It must match the signature on file to prevent rejection.

- Bank Name and Logo Pre-printed on each cheque, this identifies the issuing bank, ensuring the institution debiting your account is clear.

- MICR Line At the bottom, the machine-readable MICR (Magnetic Ink Character Recognition) line contains three key numbers—routing, account, and cheque number—printed in special magnetic ink to facilitate high-speed processing.

Understanding the MICR Routing Number

The MICR line is the hallmark of cheque processing. It uses magnetic ink to encode data that cheque-sorting machines read with nearly zero error.

| Component | Position in MICR Line | Purpose |

| Routing Number | Leftmost 9 digits | Identifies your bank or credit union |

| Account Number | Middle sequence (8–12 digits) | Directs funds to your specific account |

| Cheque Number | Rightmost group of digits | Tracks individual cheques |

Routing numbers (often called ABA numbers in the U.S.) tell the automated clearinghouse where to route your cheque. The account number specifies which of your accounts funds should be deducted from. Finally, the cheque number helps you—and your bank—track which cheques have cleared.

How Banks Verify Authenticity: Cheque Security Features

Even in our digital age, cheque fraud remains a real threat. Modern cheques incorporate multiple security measures to make counterfeiting, alteration, or copying nearly impossible.

- Watermarks and True-Foundry Seals Embedded during paper manufacturing, watermarks become visible when held up to light. They’re virtually impossible to replicate with a home printer.

- Microprinting Tiny text—often along signature lines or borders—appears as a solid line to the naked eye. Under magnification, you’ll read something like “Secure Check.” Copies crumble microprinted details, revealing forgeries.

- Thermochromatic (Heat-Sensitive) Ink A small symbol—like a key icon—prints in heat-reactive ink. When you rub it, the image briefly disappears, proving the cheque is genuine and fresh from the printer.

- Fluorescent Fibers Embedded fibers glow under ultraviolet light. Banks use UV scanners during clearing to confirm these fibers are present throughout the cheque paper.

- Void Pantograph A hidden background message that only appears when someone tries to photocopy the cheque. The word “VOID” emerges on copies, instantly invalidating them.

- Chemical Protection Paper Special coatings react to solvents used in “washing” a cheque. Any attempt to erase or alter the amount leaves brown or black stains that flag tampering.

- Print Lock Coating A clear overlay bonds toner to cheque paper in laser-printed cheques, preventing toner from being scraped off or lifted for illicit reuse.

- Image Survivable Features (ISF) Advanced solutions like Unique Coded Numbers (UCN) and encrypted QR codes ensure that digital images of cheques remain verifiable during electronic truncation processes.

Why Cheque Anatomy Matters for You

Knowing what each part of a cheque does isn’t just academic. It helps you:

- Avoid Costly Mistakes: A misplaced decimal in the numeric box—or forgetting “and 00/100” on the written line—can lead to payment issues or legal disputes.

- Spot Fraud: Familiarity with security features lets you verify a cheque’s authenticity before depositing or accepting it.

- Streamline Bookkeeping: Using the memo line correctly helps reconcile payments against invoices and rent rolls.

- Ensure Compliance: Cheques older than their validity period (usually three months) are treated as stale and may bounce.

If you need personalized cheques that incorporate top-tier security features, you can Order Personal Cheques with Print & Cheques Now.

From Single to Duplicate: Choosing the Right Cheque Type

Businesses and individuals often debate whether to use single-ply or duplicate cheques. Here’s a quick comparison:

| Feature | Single Cheque | Duplicate Cheque |

| Carbon Copy | No | Yes (immediate record) |

| Record Keeping | Manual logging | Automatic imprints |

| Bulk Payments | Less convenient | Ideal for invoices |

| Cost | Lower | Slightly higher |

If you issue payments that require an instant backup—such as vendor checks—you might prefer to Duplicate vs Single Cheques for smoother audits and fewer data-entry errors.

How Electronic Clearing Systems Use Cheque Images

With cheque truncation systems (CTS), banks no longer move paper cheques physically between branches. Instead, high-resolution images and MICR data travel electronically. This speeds up clearing, reduces fraud, and cuts costs.

- Image Survivable Features (ISF) like UCN ensure that digital images of your cheque still bear encrypted codes to confirm authenticity.

- Continuous Clearing processes allow same-day or even real-time availability of funds in many regions.

To learn more about how cheques evolve in the digital era, see our detailed guide on Cheque Anatomy Explained.

Best Practices When Writing or Receiving Cheques

- Use a ballpoint pen to prevent washing.

- Fill every blank space—draw lines after the payee and amount.

- Always confirm security features before accepting unfamiliar cheques.

- Reconcile cheques weekly to catch any unauthorized transactions early.

- Store unused cheque books in a secure location.

Frequently Asked Questions

What is a MICR routing number and why is it magnetic?

A MICR routing number is the nine-digit code at the bottom left of your cheque. Printed in magnetic ink, machines read it electronically to sort and route cheques rapidly, reducing errors and speeding up clearing.

How long is a cheque valid after the issue date?

Most cheques are valid for three months from the date written on them. After that, banks consider them stale and may refuse to process them.

What should I do if a cheque I receive lacks security features?

If a cheque misses visible watermarks, microprinting, or thermo-reactive ink, ask the issuer for a replacement on secure stock. Never deposit suspicious cheques.

Can duplicate cheques prevent fraud?

Duplicate cheques help with record-keeping but don’t inherently add security against fraud. Always verify built-in security elements regardless of cheque type.

Why does my bank require cheques to be crossed?

Crossed cheques (two parallel lines on the front) mandate deposit into a bank account only, preventing cash payouts and reducing the risk of theft.