Order Intuit/QuickBooks Alternative Cheques Online

Buying cheques through QuickBooks (Intuit/QuickBooks) isn’t your only choice—and it’s often not the smartest one. At Print & Cheques Now Inc., you get more value, faster delivery, and better security with every order of QuickBooks-compatible cheques.

We’re a Canadian-owned, family-run company with over 30 years of cheque manufacturing experience. That means every order is backed by personal service, CPA-accredited compliance, and the strongest fraud-prevention features in Canada.

Intuit vs. Print & Cheques Now: The Real Difference

If you order cheques through Intuit/QuickBooks you can save time and money today by ordering from Print & Cheques Now for a safe and convenient experience.

Here is how we compare:

Product Features |

Print & Cheques Now |

Intuit / Quickbooks |

Pricing & Value |

✅ 25% more laser cheques free, 50% more manual cheques free, plus AIR MILES® Reward Miles on every order | Starting at $238.00 for 250 Basic Voucher Checks |

Delivery Speed & Service |

✅ Same Day Printing and Available Next Day Shipping Options across Canada | Standard processing can take up to 6 business days |

Cheque Quantity |

✅ 25-60% More Cheques Free | Standard quantities |

Security Features |

✅ Higher security at no extra cost, including Heat-sensitive ink + optional Hologram Gold Foil | Standard Security Features |

Ordering Process |

✅ Simple online ordering with instant proofing 24/7. Editable PDFs that can be faxed or emailed. | Through the proprietary Intuit portal |

Why Canadian Businesses Are Switching to Us for QuickBooks Cheques

Personal Service From a Canadian Team

As a family-owned business, we take pride in building strong relationships. Our team is based entirely in Canada, so you will always speak with people who understand your needs.

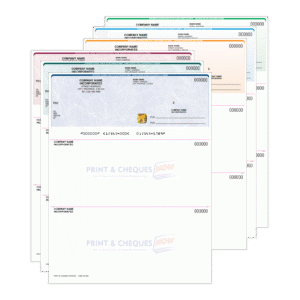

Custom Options That Reflect Your Brand

Choose from 10 background colours, add your Black Ink logo for a $20 one time setup, or increase your brand awareness by printing a full color logo., or request rush service for just $25. Your QuickBooks cheques can be as unique as your business.

Built-In Security for Peace of Mind

All our cheques meet or exceed the highest Canadian security standards, helping protect your business against fraud. These cheque features include Heat Sensitive Ink, Available Hologram Gold Foil, Micro Printing, True Watermark and more.

Experience You Can Count On

With more than 30 years in cheque manufacturing, we’ve earned the trust of businesses nationwide to deliver accuracy, reliability, and compliance with CPA standards.

For more details on cheque standards, learn more about our security features.

How To Migrate Your Account

Step 1: Export Your Cheque Data

Grab a sample cheque or your bank account details.

Step 2: Submit Your First Order

Complete our editable order form or utilize our online ordering tool. Select manual or laser cheques, choose your background colour, and upload your logo if desired.

Step 3: Proof and Verify

Before we print, you’ll see an online proof of your cheque to confirm accuracy and software compatibility.

Step 4: Complete Order

Complete your order. A tracking number will be emailed to you upon shipping.

Step 5: Receive and Use Your QuickBooks Cheques

We guarantee full compatibility with QuickBooks cheques and other major accounting software. Every order is CPA-compliant and backed by our 100% satisfaction guarantee.

Frequently Asked Questions — QuickBooks Cheques From Print & Cheques Now

How do I order QuickBooks cheques quickly?

Ordering QuickBooks cheques is simple: Use our online ordering system 24/7. Or complete the PDF Order Form and send it by email or fax.

Additionally, we recognize the urgency of QuickBooks cheque orders, particularly for payroll or supplier payments. That’s why we offer optional same-day printing for most orders and optional next day delivery across Canada. In many cases, cheques can be delivered the next day. Because we produce everything in-house with a Canadian team, we maintain full control of turnaround times, ensuring reliable and predictable service.

Are laser cheques precise and secure?

Our laser cheques are exact and reliable due to stringent self-accreditation and modern print technology, ensuring your business meets all banking standards with top-level security and precision.

Is support provided during the cheque printing process?

Print & Cheques Now offers hands-on help throughout your cheque printing process, with our team ready to answer queries, provide guidance, and ensure your orders meet required standards.

Do I need to buy cheques directly from Intuit or QuickBooks?

No. Many Canadian businesses assume they must order Intuit cheques directly from that software or through QuickBooks, but that’s not the case. Cheques can be purchased from any accredited supplier.

In fact, Intuit does not manufacture your cheques, they instead partner with a cheque manufacturer Davis & Henderson/D+H to fulfil your cheques order. Save Money and reduce your cost by ordering directly from us.

What security measures protect these business cheques?

Our cheques feature top-grade protection with built-in fraud guards, bank clearance systems, and strict industry-standard measures to ensure safe transactions with both manual and computer cheques. These include Heat Sensitive Ink, Hologram Gold Foil, Toner Adhesion, Micro Printing, True Embedded Watermark and more.

Are you an accredited cheque printer?

Yes! We are a Payments.ca Self Accredited Cheque Printer as part of the Cheque Printer Self Accreditation Program (CPSA Program) and our Printer ID # 1010 is printed on the back of every cheque we produce. We meet the requirements of the CPSA program and produce cheques compliant with the Canadian payments system’s Standard 006.

Secure and Seamless QuickBooks Cheques Printing

Make the switch today and stop overpaying for QuickBooks cheques. Join Canadian businesses already saving money, getting faster service, and enjoying premium security with Print & Cheques Now.

*Trademark Notice Intuit and Quickbooks are trademarks or registered trademarks of Intuit Inc. Print and Cheques Now Inc. is an independent company and is not affiliated with, endorsed by, or sponsored by Intuit Inc.

**Comparative Information Mentions of Intuit and/or Quickbooks are strictly for comparison purposes and to inform customers about available alternatives. All trademarks remain the property of their respective owners. Comparisons are based on publicly available information and are not intended to suggest any partnership or endorsement.