Business Cheques for Canadian Banks • Since 2006

Order Business Cheques for Any Canadian Bank in Minutes

Secure, Affordable Cheque Printing in Calgary

- Guaranteed to work at all Canadian banks

- Compatible with major accounting software

- Backed by our 100% “Works-At-Your-Bank” Guarantee

Want To Print Business Checks Fast?

- Step 1: Choose your business cheques below.

- Step 2: Enter your details (about 20 minutes on average).

- Step 3: We print and ship, all backed by our guarantee.

In a rush? Step 1: Choose your cheque type below. Step 2: Enter your details (about 20 minutes on average). Step 3: We print & ship — all backed by our guarantee.

Prefer To Order Cheques by Phone?

Call us at 1-866-760-2661 Mon–Fri, 9 am–7 pm EST / 7 am–5 pm MST, and we’ll walk you through your order.

- Works with QuickBooks • Sage • Xero • Quicken & more

- 724+ Google reviews • 4.8★ rating

Members: CPB Canada, CCA, CCC

- Ownership group with 84+ years of combined printing experience

- Did you click on us while searching for your bank or another supplier? If you need business cheques that work at your bank, you’re in the right place.

- Already have corporate cheques from somewhere else? In many cases, we can match your layout and software, so the transition is simple.

- Trusted by 50,000+ Canadian businesses since 2006

- Bank-grade MICR & CPA-compliant cheque layouts

- Standard delivery within 10 business days

- Rush options with delivery as fast as the next day across Canada

- Members: CPB Canada • CCA • CCC

Find Business Cheques That Work at Your Bank

If you’re searching for business checks for your bank or another cheque supplier and clicked our result, here’s the rundown on why you should choose Print & Cheques Now™:

- Any Canadian bank: Our business cheques follow CPA specs and are guaranteed to work at your branch.

- Matches your setup: We support the major accounting programs and most cheque formats.

- Fast delivery: Standard orders are delivered within 10 business days, with rush options available for next-day delivery across Canada.

If that’s what you’re looking for, then you’re ready for Step 2: choose your cheque type below!

Quick Answers To the Big Questions

- Will these work at my bank? Yes, or we fix or replace at no cost under our 100% “Works-At-Your-Bank” Guarantee.

- Is this secure? Yes, multiple built-in cheque security features plus secure online ordering.

- Can I reorder easily? Yes. Once set up, most customers reorder in under 30 seconds and continue to do so over time.

Step 2: Choose Your Custom Business Cheques & Start Your Order

Select the type of personalized cheques that fits how you pay vendors, staff, and expenses. You can always call us if you’re not sure, and we’re happy to walk you through the ordering forms.

Laser Business Cheques

Designed for accounting software like QuickBooks, Sage, Xero, Quicken, and more.

- An address imprint is included on most formats; a logo imprint is available.

- Standard security features are built into every cheque.

- These are ideal for regular payables and payroll runs.

Offer: Get 25% more cheques free on every Laser order. That’s about $102.50 in extra value on a 1000-qty order.

Save 30–50% vs. many bank cheque prices.

Start Laser Business Cheques OrderManual Business Cheques

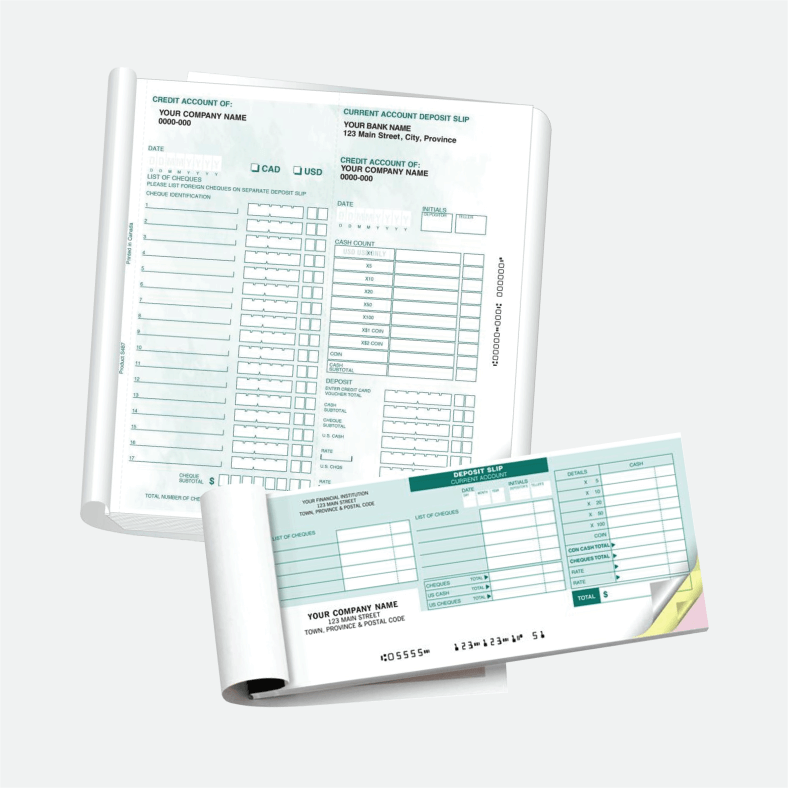

High-security manual cheques in durable books, ready for handwritten payments.

- Clear cheque stubs help keep records organized

- Great when you don’t print cheques from software

- Easy to use on job sites or in the field

Offer: Get 50% more cheques free on every Manual order, about $75.50 in savings on a 300-qty order.

Simple, reliable, and bank-approved.

Start Manual Business Cheques OrderBlank Business Cheques

Premium blank personalized cheques for business are stock-ready for your in-house laser printer and software.

- Bank-spec layout and cheque positioning

- Security features are baked into the paper

- Great when your system prints all details onto the cheque

Flexible for multiple accounts and locations.

Order Blank Business ChequesPersonal Cheques

Secure personal cheques with personalization and quick delivery.

- Match your style while keeping bank processing simple

- Options for different chequebook styles

Offer: Get 60% more cheques free on every Personal order — about $35 in savings on a 100-qty order.

Shop Personal ChequesCheque-Related Products

Deposit books, envelopes, covers, stamps & more — everything you need to keep banking smooth.

Shop Cheque AccessoriesNot sure which cheques to choose? You can call us at 1-866-760-2661, and we’ll help you pick the right business checks.

Why Businesses Switch To Cheques Now™

Same standards your bank uses, with faster service, better value, and human support.

-

Guaranteed to Work

Meets CPA specs with verified MICR for clean scans at Canadian branches, backed by our 100% “Works-At-Your-Bank” Guarantee.

-

Fast Delivery Options

Standard orders are delivered within 10 business days, with rush delivery available as fast as the next day across Canada.

-

Security Built-In

Microprint, holograms, heat-sensitive ink, and more on the cheque stock for added protection.

-

Save vs. Banks

Bank-level quality without bank-level prices. Many customers save 30% to 50% plus get free extra business cheques on every purchase order.

-

Easy Reorders

Once set up, most customers reorder cheques online in under 30 seconds using saved details.

Ready to switch? Start your Laser Business Cheques order or call 1-866-760-2661 and we’ll help you get set up.

Custom Cheques Made for How You Work

Whether you handle the books, run the company, or manage the front desk, ordering cheques should be straightforward.

-

For Bookkeepers & Accountants

Accurate. Compatible. Repeatable.

- Plug-and-play formats for major accounting software.

- Clear stubs so reconciliation is simple.

- Once set up, reordering takes seconds — not minutes.

Most choose: Laser Business Cheques -

For Owners & Controllers

Control Costs, Not Quality.

- Save vs. bank pricing while keeping bank-level standards.

- Built-in security to help reduce risk.

- Fast delivery so payments don’t slow down operations.

Popular choice: Laser Cheques or Manual Cheques -

For Admin & Office Teams

Simple Online Ordering.

- Clear step-by-step order flow with plain instructions.

- We verify details before printing to catch issues.

- Need help? Call and speak to a real person.

Start here: Order Laser Business Cheques or call 1-866-760-2661.

Step 3: Complete Your Order in a Few Minutes

Here’s exactly what happens after you click “Start Order.”

-

Pick Your Cheque Type

Choose Laser, Manual, or Blank business cheques, and pick your accounting software or layout if needed.

-

Enter Details & Upload Sample (Optional)

Add branding and bank details, logos, and accounts. You can upload a sample cheque if you want us to match your current layout.

-

We Verify, Print & Ship

We review your order for accuracy, print to bank-quality standards, and ship it to you. Standard delivery is within 10 business days, with rush options available as fast as the next day across Canada.

When you click below, you’ll see your options, quantities, and pricing before you pay. Start your business cheque order now.

Stop Overpaying at the Bank

Get the same core standards as bank cheques, with more flexibility, support, and savings.

|

Feature |

Bank |

Cheques Now™ |

|

MICR accuracy |

Standard |

Bank-grade MICR, triple-verified |

|

Software compatibility |

Limited |

QuickBooks, Sage, Xero, Quicken & more |

|

Turnaround/delivery |

Multi-step, less flexible |

Standard delivery within 10 business days, rush as fast as the next day |

|

Price per box |

Higher |

Many customers save 30–50% vs. bank pricing |

|

Extra value |

Standard qualities only |

Free extra cheques on every order (25–60% more depending on product) |

Savings vary by format, quantity, and product type.

Ready to stop overpaying? Start your Laser Business Cheques order or call 1-866-760-2661 now.

Loved by Canadian Businesses

“Switched from the bank and got way more cheques for the money. No issues at deposit.”

— Customer in Ontario

“Easy order, clear proof, and fast printing. Cheques look professional.”

— Customer in Alberta

“Love earning AIR MILES on something I need anyway.”

— Customer in British Columbia

Average 4.9/5 on Google (724+ reviews).

Join businesses across Canada who have already switched. Start your business cheque order now.

Order With Confidence: 100% “Works-At-Your-Bank” Guarantee

If your business checks don’t process at your bank, we’ll fix or replace your order at no cost. If we make an error, we reprint and reship for free. If the error is on your side, we still feel your pain and offer a 50% off rerun to get you back on track quickly.

We stand behind every cheque we print, and we work with you and your bank to resolve any issues fast.

Custom Business Cheques — FAQs

Answers to the most common questions before you place your order.

Are Cheques Now™ business cheques accepted at all banks?

Yes. We follow CPA bank specifications with verified MICR encoding and multiple security features. Our 100% “Works-At-Your-Bank” Guarantee means if your bank has an issue, we fix or replace the order at no cost.

Which accounting software do you support?

We support QuickBooks, Sage, Xero, Quicken, Wave, FreshBooks, and more. Choose your software during your order, or share your existing cheque sample so we can match the layout.

How fast can you ship and deliver?

Standard orders are typically delivered within 10 business days once artwork and details are approved. Need them faster? Rush delivery options are available with delivery as fast as the next day across Canada.

What do I need to have ready before I order?

It helps to have:

- A void cheque or image of your current cheques (if available).

- Your bank transit, branch, and account numbers.

- Your company's legal name and address as they should appear.

- Your logo file, if you want it printed.

If you’re missing something, you can still start. We’ll let you know if we need more details.

Can you match my current checks from another supplier or bank?

In many cases, yes. You can upload a sample or provide details during ordering, and we’ll work to match the format and layout. If we have questions, we’ll contact you before printing so there are no surprises.

What happens if there’s a printing error or something doesn’t look right?

If we make a mistake with your purchase order, we will correct it quickly. We reprint and reship at no cost to you. If the error stems from incorrect information provided to us, we feel your pain and offer to help you obtain new cheques without paying the full price again. Just contact our team via email or phone.

Is ordering online secure?

Yes. Our site uses secure connections for online ordering, and payments are processed through trusted providers. Your business and banking details are handled carefully and used only to produce your cheques.

How long does it take to place an order online?

Most customers complete their first order in about 20 minutes. Once your account and layout are set up, reorders can be done in under 30 seconds using saved details.

Do you sell personal checks and accessories?

Yes. See our Personal Cheques and Cheque-Related Products pages for envelopes, deposit books, binders, and more.

What’s the difference between laser, manual, and blank cheques?

- Laser cheques: Ideal for high-volume, software-based payments

- Manual cheques: Best for handwritten payments or field use

- Blank cheques: For in-house printing on your own system

Can I print business checks in-house?

Yes, blank check stock is compatible with major accounting software and includes built-in security features.